New QUICK survey: Few institutional investors have changed policies due to the Ukraine situation.

TOKYO, JAPAN, September 13, 2023/EINPresswire.com/ — The ESG Research Center of the Enterprise Services Dept. at QUICK Corp. released its “ESG Investment Survey 2022” on January 19. Previously, the first issue had examined ESG investment methodologies and promotional structures, while the second issue had been focused on engagement themes. The newest and third issue covers the impact of the situation in Ukraine on ESG investment policies and ESG investment plans in five years, which was asked as a special question.

[Notable Points]

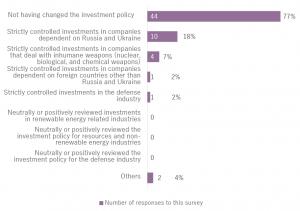

● 77% of the respondents selected “Not having changed the investment policy” with regard to ESG-related assets due to the situation in Ukraine. The most common choice among those who had made such changes was “Strictly controlled investments in companies dependent on Russia and Ukraine” (18%).

● As for the percentage of ESG-associated investments among total outstanding assets under management for Japanese stocks in five years, respondents chose either “Maintain the status quo” (70%) or “Increase” (30%), with no respondents saying they would “Decrease.”

【Figure 1: Impact of the situation in Ukraine on ESG investment policy】

Has the situation in Ukraine changed your ESG investment policy? Please choose one answer.

As noted above, nearly 80% of respondents chose “Not having changed the investment policy.” This was because they already had a monitoring system in place for companies dealing in inhumane weapons, while they see international cooperation on climate change issues and the transition to decarbonization remaining unchanged. The situation in Ukraine has reminded investors of the impact of country-related risk on companies. Some organizations have made alterations to their investment portfolios, but overall, they accounted for a minority.

The survey results suggest that “negative screening,” which excludes companies that derive revenue through certain unethical businesses, etc. from investments, and “screening based on international norms” are already in place and functioning.

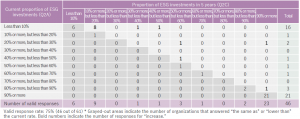

【Figure 2: Proportion of ESG investments in 5 years】

Looking ahead 5 years at your company, roughly what percentage of total outstanding assets under management for Japanese stocks do you expect will be ESG-related investments?

In answer to the above question, 14 of the 46 organizations that gave valid responses said they would increase the percentage in the coming 5 years. The remaining 32 organizations answered they would maintain the status quo, presumably because the percentages of their investments accounted for by ESG-related assets are approaching their upper limits. In fact, 21 (66%) organizations that gave this answer have a current ESG-related investment percentage of 90% or higher.

ESG investors are being forced to make difficult decisions as the valuations of energy-related stocks rise in the wake of Russia’s invasion of Ukraine. Nevertheless, there is a view that the transition to clean and sustainable energy sources should be funded for security reasons and not just due to climate change. The survey results suggest there is no sign of a change in the mid- to long-term expansion of investments that take climate change and other ESG-associated issues into account.

[Outline of Survey]

QUICK ESG Investment Survey 2022

● 170 institutional investors based in Japan selected from the companies that have declared acceptance of the “Japanese Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI)

● The number of responding organizations was 61 (of which 13 are asset owners and 48 are asset managers).

● The survey period was from August 22 to October 4, 2022.

(Reported on January 19)

Get the full version report for free:

https://quickmk.smktg.jp/public/application/add/7214

[ESG Investment Survey 2022] (1)

[ESG Investment Survey 2022] (2)

Popular NISA Stocks Also Enjoy Strong Performance

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

![]()

Article originally published on www.einpresswire.com as Only a Few Institutional Investors Changed Policies due to the Ukraine Situation